The Amazon of Agriculture!

Hello,

I was going continue with an analysis of Technology Revolutions and Financial Capital in Agriculture, but shortly after publishing I came across the news of the Agrofy’s capital raise, I wasn’t overly familiar with them prior and they do seem impressive, but it caused me to think more about what does the “Amazon of Agriculture” even mean?

Often in AG, to be considered in the “Amazon of AG” discussion, all you need is a website and the ability to transact online. That is an odd view as during Amazon’s infancy, it was actually a hassle to buy online and wait the long term to ship, Amazon’s early days were not easy for many shareholders either:

It is easy to look back now with hindsight and survivorship bias, the market was probably occasionally right reacting to news and it took a lot of time for many investors to make their money back, assuming they held from $100 down to $8 per share.

As Customers, Why Do We Like Amazon?

While there are many known and also subconscious reasons we don’t think twice about our Amazon Prime subscription, the major factors Amazon has provided us include;

Low cost products

Fast shipping

Wide selection

This seems pretty universal to everyone, Bezos often says fast shipping and low costs are not a trend and Amazon will continue to invest in their moat as the “the earth's most customer-centric company” to presumably be “the everything store”. These objectives and strategies are all in place for Amazon’s financial goal to maximize free cash flow per share over the long term.

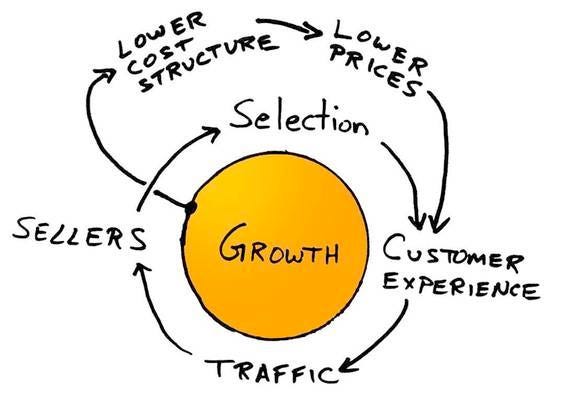

Network Effects and Growth

When thinking about Amazon, it is important to identify how they continue to accelerate. I found this in a a16z blog:

Once this flywheel got started, it hasn’t stopped, you will notice in the description below that Amazon keeps making investments and decisions that reinforce this flywheel and their moat.

Funding Strategy

It is also important to identify how Amazon was able to fund itself on top of the feedback loop above, and it was not perpetual VC funding at crazy valuations, but primarily a negative cash conversion cycle (float) in addition to lease financing for their distribution and data centres.

The power is in the float, as they continued to grow revenue, their free cash flow conversion followed as Customers were paying them at the point of the transaction while they often weren’t paying suppliers for 90 days. This funding strategy was not without risk, if revenue declines it is a vicious cycle backwards (hence the survivorship bias). Other examples of this working well is with insurance companies, gift card co’s and payroll processors such as ADP.

Now that we have identified Amazon’s business model and funding strategy, why are they able to consistently provide Customers with a superior value proposition that has driven their meteoric revenue growth.

Customer Obsession

The reason Customers love Amazon is that Amazon loves Customers! Customer Obsession is the number one principle for Amazon’s leadership team and it permeates throughout the company. They have continuously sought to remove friction from the buying experience, whether that be with enhanced shipping options, product recommendations or the patented 1-Click buying process. There are anecdotes all over about how Amazon, among the the most data centric companies in the world will overlook data in favour a Customer complaint.

With a customer obsession mindset, their management team is not bound to e-commerce because of their origins, as you see with Whole Foods and various storefront, they are solely focused on improving Customers’ lives in order to enhance their global take rate.

Ag Angle: What companies have this level of Customer Obsession? Are there business models in the value chain that would permit a similar level of flexibility in strategy to achieve that level of customer success?

Distribution Scale

Amazon has opened more than 100 distribution centres near cities in recent years to improve their delivery speed towards 2-day and more recently 1 day shipping. Their distribution centre expansion allowed them to save a significant portion of their cost per shipment.

This is a core part of the value proposition offered by Amazon, they do not think rapid shipping will ever go out of fashion. Rapid shipping times have allowed Amazon to widen their moat in recent years as they have raised the expectations of Customers, as they move into 1 day shipping, the mall continues to lose relevance for every day generic purchases. When you throw in the illusion of “free” shipping, Amazon is a no-brainier for most people to use.

Ag Angle: There is no question that timeliness of delivery is critical for Farmers, whether that be a seed product that is embedded in a crop plan generated in prior months, or a specific chemical to react to recent weather events. How can a company develop a similar distribution scale to Amazon in order to serve Customers with the same level of speed and effectiveness?

Digital Portal

This is where you usually hear the “Amazon of Ag” comparisons come from. With their website, Amazon makes it super easy to buy products, both with their 1-click purchasing and also how Amazon always makes very accurate recommendations. They are able to make these recommendations by tracking a wide variety of your behaviour and then also having very effective algorithms. These factors are estimated to give Amazon an astounding 74% conversion rate on Prime Customers, for reference Wal-Mart is estimated to be in the single digits.

Ag Angle: What companies/solutions have access to adequate Farm data that enables decisions with the entire Farm in mind for the entire cycle? Which company/technology has performance metrics that are 10x the previous leader/solution?

Private Label to Reduce Costs and Increasing Gross Profit Dollars

Depending on your perspective of where Amazon was (1st Party sales) or where it generates more volume today (3P), you can’t deny that Amazon is trying to secure more of the value out of each transaction, whether that be advertising and related fees in the 3P business or offering Amazon Basics (and other captive brands) in their 1P business. Their captive brands drive down the average price of key items we use everyday, such as phone chargers and batteries etc. They don’t take much (if any) R&D risk on these products and are able to plug these into their relationships to generate lower prices for competitors.

Ag Angle: Most captive brands we are seeing in Ag today are focused around generic chemicals, does that have the same effect of improving retention or it is just a continuation of price checking and race to the bottom?

Concluding Thoughts

I think it is clear that anyone trying to become the “Amazon of Ag” needs to bring more than the ability to shop online, they also need to bring massive amounts of capital to execute in line with the financial outcomes experienced by Amazon. It is also easy to argue that one may not want to replicate the Amazon that Bezos began with, as their value creation is arguably lead by their North American 3P business and Amazon Web Services.

For investors looking to invest in a similar opportunity it is important to think about the early days of Amazon, they faced incredible volatility as all startups do, people are quick to identify a super low price Amazon traded at and say “What if..” - it is extremely unlikely anyone managing a portfolio will stick with a company after a 10x, 100x etc - it is not easy to stick with, yet that type of performance is critical if that company is going to replicate Amazon’s take rate for agriculture.

Amazon was able to avoid excessive dilution and interest expense by funding their growth via their working capital float. The float allowed them to accelerate growth and commensurate shareholder returns, a comparable innovation in funding is likely critical to achieve Amazon’s level of dominance within an industry.

With all that, I think a business that is Farmer obsessed that can offer low prices, without much transaction friction and deliver in a timely manner is a business worth investing in. That business is likely not VC funded but deep into the building process.